In today's fast-paced business world, the concept of buying and selling businesses, or "biz buy sell," has gained significant traction. Entrepreneurs, investors, and business owners are constantly on the lookout for opportunities to either acquire a new venture or sell an existing one. Understanding the intricacies of this process can be a game-changer for anyone looking to thrive in the business landscape.

Whether you're a seasoned entrepreneur or a novice in the world of business transactions, navigating the complexities of biz buy sell requires a strategic approach and a keen understanding of market dynamics. It's not just about finding the right buyer or seller; it's about maximizing value, minimizing risks, and ensuring a smooth transition. This comprehensive guide will delve into the various aspects of biz buy sell, providing you with the knowledge and tools needed to succeed.

From understanding the fundamental principles of business valuation to mastering the negotiation process, this article will cover everything you need to know about biz buy sell. With detailed insights, expert advice, and practical tips, you'll gain the confidence to make informed decisions and achieve your business goals. So, let's dive into the world of biz buy sell and discover the key strategies that can set you on the path to success.

Table of Contents

- Understanding Biz Buy Sell

- Why is Biz Buy Sell Important?

- How to Prepare for a Biz Buy Sell?

- The Role of Business Valuation in Biz Buy Sell

- What to Look for in a Business to Buy?

- How to Find the Right Buyer for Your Business?

- Negotiating the Deal: Tips and Strategies

- Legal Aspects of Biz Buy Sell

- Financing Options for Biz Buy Sell

- Due Diligence in Biz Buy Sell

- How to Ensure a Smooth Transition?

- Common Pitfalls in Biz Buy Sell and How to Avoid Them

- The Future of Biz Buy Sell: Trends and Predictions

- Frequently Asked Questions

- Conclusion

Understanding Biz Buy Sell

Biz buy sell is an integral part of the business ecosystem, encompassing the processes involved in buying and selling businesses. It involves a wide range of activities, from evaluating potential businesses for acquisition to identifying suitable buyers for an existing business. The term "biz buy sell" highlights the transactional nature of these activities, emphasizing the exchange of ownership and control.

At the heart of biz buy sell lies the concept of value creation. Buyers aim to acquire businesses that align with their strategic goals and offer potential for growth and profitability. Sellers, on the other hand, seek to maximize the value of their business and achieve a successful exit. Understanding these dynamics is crucial for anyone looking to navigate the world of biz buy sell effectively.

Biz buy sell transactions can vary significantly in complexity, depending on factors such as the size of the business, the industry in which it operates, and the specific goals of the parties involved. As such, it's essential to approach each transaction with a tailored strategy that takes these variables into account. By doing so, you can ensure that you're making informed decisions that align with your objectives.

Why is Biz Buy Sell Important?

Biz buy sell plays a vital role in the business landscape for several reasons. Firstly, it facilitates the efficient allocation of resources. By enabling the transfer of ownership, biz buy sell allows businesses to be managed by those best equipped to realize their potential, thereby driving economic growth and innovation.

Secondly, biz buy sell provides a mechanism for business owners to exit their ventures. Whether they're looking to retire, pursue new opportunities, or address financial challenges, selling a business can be a strategic move that allows owners to unlock the value they've built over time.

Finally, biz buy sell offers opportunities for entrepreneurs and investors to enter new markets, expand their existing operations, or diversify their portfolios. By acquiring businesses that complement their own, they can leverage synergies, achieve economies of scale, and enhance their competitive position.

How to Prepare for a Biz Buy Sell?

Preparation is key to a successful biz buy sell transaction. Whether you're buying or selling a business, taking the time to plan and organize your approach can make a significant difference in the outcome. Here are some essential steps to consider:

1. Define Your Objectives

Before embarking on a biz buy sell transaction, it's crucial to have a clear understanding of your objectives. What are you hoping to achieve by buying or selling a business? Are you looking for growth opportunities, financial returns, or strategic advantages? By defining your goals, you can tailor your approach and focus on what truly matters.

2. Evaluate Your Resources

Consider the resources you have at your disposal, including financial capital, expertise, and time. Assessing your capabilities and limitations will help you determine whether you're in a position to pursue a biz buy sell transaction and what type of business would be a good fit.

3. Conduct Market Research

Understanding market trends, industry dynamics, and potential opportunities is essential for making informed decisions. Conduct thorough research to identify businesses that align with your objectives and offer the potential for success.

4. Assemble a Team of Experts

A successful biz buy sell transaction often requires input from various professionals, including accountants, lawyers, and business brokers. Assemble a team of experts who can provide valuable insights and support throughout the process.

The Role of Business Valuation in Biz Buy Sell

Business valuation is a critical component of the biz buy sell process, providing a basis for determining the fair market value of a business. It involves assessing various factors, such as financial performance, market position, growth potential, and risk, to arrive at an accurate estimate of a business's worth.

For buyers, understanding the value of a business is essential for making informed investment decisions. It allows them to assess whether the asking price is reasonable and determine the potential return on investment. For sellers, a thorough business valuation can help them set a realistic asking price and negotiate effectively with potential buyers.

Several valuation methods can be used in biz buy sell transactions, including:

- Income Approach: This method assesses a business's value based on its projected future income and cash flow.

- Market Approach: This method compares the business to similar companies that have been sold recently, using market data to determine its value.

- Asset Approach: This method evaluates the business's value based on its assets and liabilities, considering factors such as tangible and intangible assets.

Choosing the right valuation method is crucial for obtaining an accurate estimate of a business's worth. It's often advisable to consult with a professional valuator who can provide expert guidance and insights.

What to Look for in a Business to Buy?

When considering a business to buy, it's essential to conduct a thorough evaluation to ensure that it aligns with your objectives and offers the potential for success. Here are some key factors to consider:

1. Financial Performance

Examine the business's financial statements, including revenue, expenses, profit margins, and cash flow. Assess its historical performance and future projections to determine its financial health and growth potential.

2. Market Position

Evaluate the business's position within its industry, including its market share, competitive advantages, and brand reputation. Consider whether it operates in a growing or declining market and how it compares to competitors.

3. Customer Base

Analyze the business's customer base, including its size, demographics, and loyalty. A diverse and loyal customer base can provide a stable revenue stream and contribute to long-term success.

4. Management Team

Consider the experience, skills, and track record of the business's management team. A capable and motivated team can drive growth and innovation, making the business an attractive investment.

How to Find the Right Buyer for Your Business?

Finding the right buyer is crucial for achieving a successful biz buy sell transaction. The right buyer should not only be willing and able to meet your asking price but also be a good fit for the business in terms of experience, vision, and values. Here are some strategies for identifying potential buyers:

1. Define Your Ideal Buyer Profile

Consider the characteristics of your ideal buyer, including their industry experience, financial capacity, and strategic goals. Having a clear profile in mind will help you focus your search and evaluate potential buyers more effectively.

2. Leverage Professional Networks

Utilize your professional networks, including industry associations, business brokers, and advisors, to identify potential buyers. Networking can provide valuable leads and introductions to interested parties.

3. Advertise Your Business

Consider advertising your business for sale through online platforms, trade publications, and industry events. A well-crafted advertisement can attract a wide range of potential buyers and generate interest.

4. Screen and Qualify Buyers

Once you've identified potential buyers, conduct thorough screenings to assess their qualifications, financial capacity, and compatibility with your business. This step is crucial for ensuring that you engage with serious and suitable candidates.

Negotiating the Deal: Tips and Strategies

Negotiating a biz buy sell deal requires careful planning, effective communication, and a willingness to find common ground. Here are some tips and strategies to help you navigate the negotiation process:

1. Set Clear Objectives

Before entering negotiations, define your objectives and priorities. What are your non-negotiables, and where are you willing to compromise? Having a clear understanding of your goals will help guide your discussions.

2. Understand the Other Party's Perspective

Take the time to understand the other party's needs, interests, and motivations. Empathy and active listening can help build rapport and foster a collaborative atmosphere.

3. Focus on Value, Not Price

While price is an important consideration, it's not the only factor in a successful biz buy sell transaction. Consider other elements of value, such as terms, conditions, and future opportunities, to create a win-win situation.

4. Be Prepared to Walk Away

While it's important to negotiate in good faith, be prepared to walk away if the deal doesn't meet your objectives or if you encounter red flags. Having a clear walk-away point can give you confidence and leverage in negotiations.

Legal Aspects of Biz Buy Sell

Legal considerations play a critical role in biz buy sell transactions, ensuring that the process is conducted fairly and in compliance with relevant laws and regulations. Here are some key legal aspects to consider:

1. Drafting and Reviewing Contracts

Contracts are a fundamental component of any biz buy sell transaction. They outline the terms and conditions of the sale, including price, payment terms, and contingencies. It's essential to have a qualified attorney draft and review these contracts to protect your interests.

2. Conducting Due Diligence

Due diligence is the process of thoroughly investigating a business before completing a transaction. It involves reviewing financial records, legal documents, and other relevant information to identify potential risks and liabilities.

3. Understanding Regulatory Requirements

Depending on the industry and location of the business, there may be specific regulatory requirements to address in a biz buy sell transaction. These could include licensing, permits, and compliance with industry standards.

4. Addressing Employment and Labor Issues

In a biz buy sell transaction, it's important to consider the impact on employees and address any labor-related issues. This may involve reviewing employment contracts, addressing severance or retention agreements, and communicating with staff.

Financing Options for Biz Buy Sell

Financing is a crucial consideration in biz buy sell transactions, as it determines how the purchase or sale will be funded. There are several financing options available, each with its own advantages and considerations:

1. Self-Financing

Self-financing involves using personal funds or assets to finance the transaction. This option provides full control and flexibility but may require a significant financial commitment.

2. Bank Loans

Bank loans are a common financing option for biz buy sell transactions. They offer structured repayment terms and competitive interest rates but may require collateral and a strong credit history.

3. Seller Financing

Seller financing occurs when the seller provides a loan to the buyer to facilitate the purchase. This option can make the transaction more accessible to buyers and may include favorable terms.

4. Venture Capital or Private Equity

For larger or high-growth businesses, venture capital or private equity financing may be an option. These investors provide capital in exchange for equity or a share of future profits.

Due Diligence in Biz Buy Sell

Due diligence is a critical step in the biz buy sell process, involving a comprehensive review and analysis of the business being considered for purchase. It aims to uncover potential risks, liabilities, and opportunities, allowing buyers to make informed decisions. Key areas of due diligence include:

1. Financial Due Diligence

This involves reviewing financial statements, tax returns, and financial projections to assess the business's financial health and performance. It provides insights into profitability, cash flow, and potential financial risks.

2. Legal and Compliance Due Diligence

This aspect of due diligence involves reviewing legal documents, contracts, and regulatory compliance. It aims to identify any legal issues, disputes, or compliance challenges that could impact the business.

3. Operational Due Diligence

Operational due diligence assesses the business's operations, including its processes, systems, and infrastructure. It identifies areas for improvement, potential efficiencies, and operational risks.

4. Market and Competitive Due Diligence

This involves analyzing the business's market position, competitive landscape, and growth potential. It provides insights into industry trends, customer dynamics, and potential opportunities.

How to Ensure a Smooth Transition?

Ensuring a smooth transition is crucial for the success of a biz buy sell transaction, as it minimizes disruptions and maintains business continuity. Here are some strategies to facilitate a seamless transition:

1. Develop a Transition Plan

Creating a detailed transition plan is essential for outlining the steps and timelines involved in the handover process. It should address key areas such as operations, management, and communication.

2. Communicate with Stakeholders

Effective communication with employees, customers, suppliers, and other stakeholders is vital for maintaining trust and confidence. Keep them informed about the transition process and address any concerns they may have.

3. Retain Key Personnel

Retaining key personnel, such as managers and employees with valuable expertise, can help maintain stability and continuity. Consider offering retention incentives to ensure their commitment during the transition.

4. Monitor and Evaluate Progress

Regularly monitor and evaluate the progress of the transition to identify any challenges or areas for improvement. Be prepared to make adjustments as needed to ensure a successful outcome.

Common Pitfalls in Biz Buy Sell and How to Avoid Them

Biz buy sell transactions can be complex and challenging, with several potential pitfalls that can derail the process. Here are some common pitfalls and strategies for avoiding them:

1. Overlooking Due Diligence

Failing to conduct thorough due diligence can result in unpleasant surprises and costly mistakes. Ensure that you invest the time and resources needed to conduct a comprehensive review of the business.

2. Misvaluing the Business

Incorrectly valuing the business can lead to overpaying or underselling. Work with experienced valuators and consider multiple valuation methods to arrive at an accurate estimate.

3. Inadequate Legal Preparation

Neglecting legal considerations can result in disputes and complications. Engage qualified legal counsel to draft and review contracts and address regulatory requirements.

4. Poor Communication

Failure to communicate effectively with stakeholders can lead to misunderstandings and mistrust. Maintain open and transparent communication throughout the process.

The Future of Biz Buy Sell: Trends and Predictions

The biz buy sell landscape is constantly evolving, influenced by economic, technological, and societal trends. Here are some key trends and predictions shaping the future of biz buy sell:

1. Digital Transformation

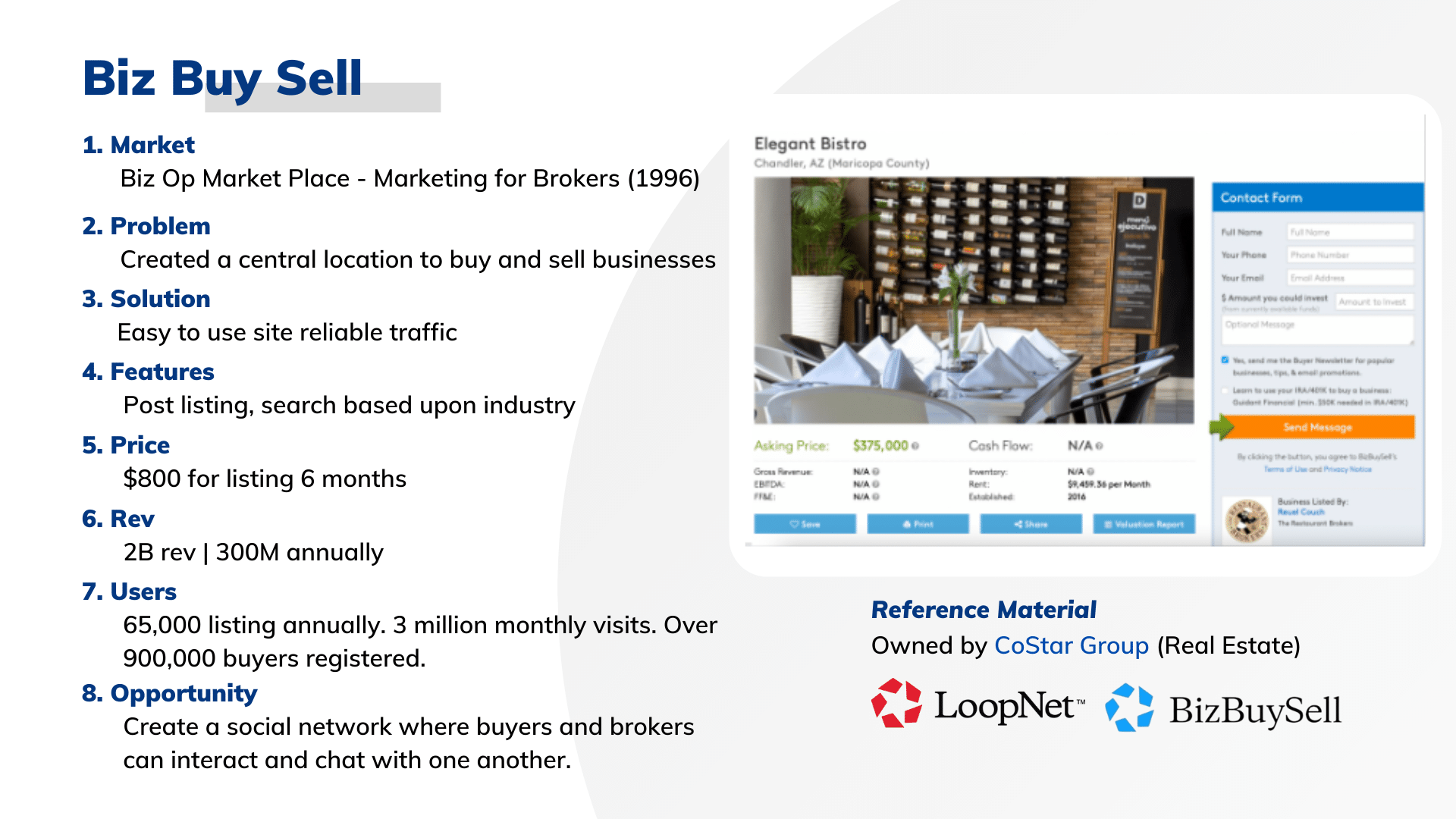

Digital technologies are reshaping the biz buy sell process, enabling greater efficiency, transparency, and accessibility. Online platforms and digital tools are streamlining transactions and expanding the reach of buyers and sellers.

2. Focus on Sustainability

Environmental, social, and governance (ESG) considerations are becoming increasingly important in biz buy sell transactions. Businesses with strong sustainability credentials are likely to attract more interest from buyers.

3. Increased Cross-Border Transactions

Globalization and the rise of digital connectivity are facilitating cross-border biz buy sell transactions. Businesses are increasingly looking beyond their local markets for opportunities and growth.

4. Emergence of New Business Models

Innovative business models, such as subscription services, gig economy platforms, and digital marketplaces, are creating new opportunities and challenges in the biz buy sell landscape.

Frequently Asked Questions

1. What is the biz buy sell process?

The biz buy sell process involves buying and selling businesses, including activities such as valuation, negotiation, due diligence, and legal considerations.

2. How do I value a business for sale?

Business valuation involves assessing factors such as financial performance, market position, and growth potential. Various methods, such as income, market, and asset approaches, can be used.

3. What are the risks of buying a business?

Risks include financial liabilities, operational challenges, and market competition. Conducting thorough due diligence can help identify and mitigate these risks.

4. How can I find a buyer for my business?

Strategies include defining your ideal buyer profile, leveraging professional networks, advertising your business, and screening potential buyers.

5. What legal documents are needed in a biz buy sell transaction?

Key legal documents include purchase agreements, non-disclosure agreements, and due diligence reports. It's essential to consult with legal counsel for guidance.

6. How long does the biz buy sell process take?

The timeline varies depending on factors such as the complexity of the transaction and the readiness of the parties involved. It can range from a few months to over a year.

Conclusion

Biz buy sell is a dynamic and rewarding process that offers opportunities for business growth, investment, and strategic exits. By understanding the key principles and strategies outlined in this guide, you can navigate the complexities of biz buy sell with confidence and achieve your business objectives. Whether you're buying or selling a business, preparation, due diligence, and effective negotiation are crucial for success. As the biz buy sell landscape continues to evolve, staying informed and adaptable will be key to seizing new opportunities and thriving in the ever-changing business world.

For more insights and resources on biz buy sell, consider visiting BizBuySell, a leading online marketplace for buying and selling businesses.

You Might Also Like

The Ultimate Guide To Finding A Mazda RX7 For Sale: Tips And TricksUnlock The Potential Of Register Star: A Comprehensive Guide

Innovative Solutions For Brick Patch And Repair Techniques

Education Excellence: Insights Into نیک فی المدرسه

Delicious Bites At Glass Nickel Pizza: A Culinary Delight

Article Recommendations